Intermediate Strategy

Description

The Intermediate strategy is appropriate for investors seeking tax free income from a high quality intermediate strategy. The goal of the strategy is to preserve capital and generate income free of federal income taxes.

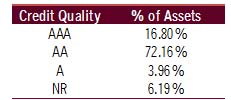

Credit Quality Chart

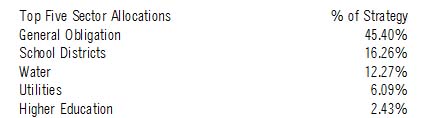

Sector Chart

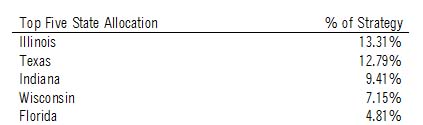

State Chart

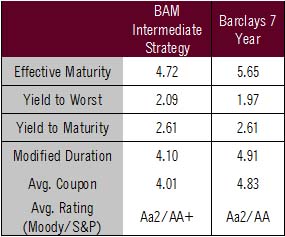

Strategy vs. Benchmark Chart

Strategy Overview

The strategy consists primarily of investment grade securities with an overall modified duration range of +/-20% to the benchmark (Barclays 7-Yr. Muni). The foundation of our process rests on our independent, in-house credit research team, which enhances our value-based investment approach by identifying suitable credits currently undervalued in the marketplace.

Portfolio Management Team

Tom Bernardi, CFA – 5 years of industry experience

Daniel Data, CFA – 16 years of industry experience

John Tranas – 26 years of industry experience

For more information find our strategies on Envestnet or Morningstar