RE: Wall Street Journal’s “Your Stock Trades Go Free but Your Cash Is in Chains”

Jason Zweig’s October 4th article underscores that transactions costs should not be the only metric investors use to evaluate investment platforms. Additionally – and as importantly – they need to consider opportunity costs, the portfolio management process, and market access (the latter, especially for munis!).

The latest news is that Schwab, TD, etc. are cutting single stock commissions to $0. So, these discount brokerage platforms are entering the not-for-profit industry? Not exactly. Zweig notes that these firms make very little revenue off of commissions. In fact, a newfound and burgeoning area of revenue growth for these firms is bank sweep accounts (as an alternative to money market funds), which is an enormous opportunity cost for investors.

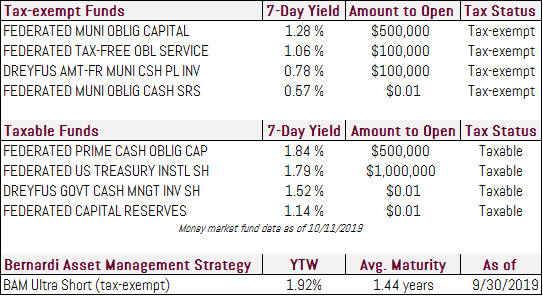

The article highlights that “most sweep accounts pay measly rates—sometimes as little as 0.05%.” Compare this to tax-exempt money market funds, which currently yield (7-day as of 10/11), anywhere from 0.57% to 1.28%.

On $1,000,000 that is a $5,200 to $12,300 difference.

Below the signature is an overview of the current money market funds we utilize paired with the YTW of our Ultra Short strategy (as of 9/30). Please call us if you are interested in receiving complete details.

Bernardi does not use bank sweep accounts, as we are not a bank. As a cash alternative, we offer money market funds and our Ultra Short strategy for portfolios – because they yield more than most bank sweep accounts. Increasing yield on cash positions is one of the many factors of our portfolio management process. This, paired with security selection, yield curve positioning, credit analysis, and market access, all help add value to client portfolios.

Oftentimes, the lead is buried by our industry. But thankfully, journalists like Jason Zweig are there to help investors understand the full picture and what matters for their portfolios.

We believe Bernardi offers investors various ways to optimize municipal bond portfolio construction and minimize opportunity costs. Please call us if you have any questions about your portfolio or our portfolio management process.

Sincerely,

Bernardi Securities & Bernardi Asset Management

October 14, 2019