The Cost of Owning Municipal Bonds

There are two possible ways an investor pays to access the municipal bond market and portfolio management services for a separately managed account:

- One-time transaction cost model (markup/down)

- Annual fee model

As a hybrid-firm (broker-dealer & registered investment advisor), Bernardi Securities (BSI) offers a choice of fee-only and one-time transaction platforms to our portfolio management clients. Properly selecting one over the other depends on the interest, needs, and strategy of the given portfolio.

On May 14th, 2018 the “markup rule” (amendments to rules MSRB G-15, G-30 and FINRA 2232) become effective requiring broker-dealers (BSI) to disclose markups/downs to retail investors for same day secondary market transactions.

We believe the amended rules are good for individuals and will serve to heighten industry transparency. At Bernardi, we have always prided ourselves on the transparency we offer regarding portfolio construction and management costs. In fact, we enable greater cost transparency compared to the rule. For many years we have made available to our portfolio managed investor clients and their investment counselors the total markups/down for each account on investments that occur throughout the year– not just on same day trades.

We began providing transparency years ago because cost metrics are an essential factor in helping you determine the appropriate municipal bond investment strategy and effectiveness of a manager. Additionally, we wanted to be at the vanguard of our industry.

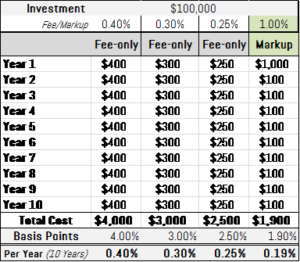

Below is a hypothetical cost analysis of a similarly sized and structured markup portfolio and an annual fee portfolio model. This should help you compare which cost platform (transaction-based or fee-based) is most attractive based on your municipal bond strategy for a separately managed bond portfolio (SMA).

*****

Fee-only Cost Inputs:

A popular version of the Bernardi Asset Management SMA platform charges an annual fee between 25-40 basis points (and a lesser fee for large portfolios) for bond portfolio management. In these scenarios an investor pays 250-400 basis points over the course of 10 years. Over ten years, for every $100,000 investment in the portfolio, the fee will be a cumulative $2,500-$4,000.

Mark-up Cost Inputs:

Compare this now to the transaction based platform cost model where each bond investment or sale is assessed with a one-time markup/markdown. Our example assumes all bonds are held to maturity. Markups vary and can differ based off of bond type, maturity, block size, market dynamics at time of trade and other factors. For this analysis we will assume a 1.00% mark-up.

Cost Overview:

Assuming a fee range of 0.25%-0.40% and a one-time markup of 1.00%, the markup option is more attractive for a 10-year laddered portfolio that experiences 10% turnover each year.

Portfolios with lower turnover and/or shorter maturities typically experience lower average markups, as well.

Take for instance an income oriented portfolio with an average 15 year maturity. Assuming markups amount to 1.25%, this averages to an annual implementation cost of only 8 basis points (0.08%) on principal invested. This does not include reinvested coupon interest, unless taken.

In Conclusion:

From a cost perspective, there is not one right answer for investors. And the above analysis should be one of many aspects of your due diligence approach to the municipal bond market.

As municipal bond specialists we are here to help you navigate the market.

Please call your Bernardi Investment Specialist or Portfolio Manager if you have any questions or would like to discuss each platform model in detail.

Sincerely,

Bernardi Securities, Inc.

May 14, 2018