Unapparent Risk in Municipal Bond Land

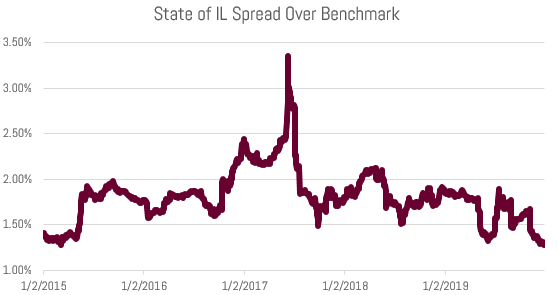

2019 municipal bond market performance has been stellar as its safe-haven status persisted in a year packed with monetary policy easing from global central banks. The Bloomberg Barclays long-term tax-exempt index is up 7.54% YTD.[1] While 4Q information is not available, Bernardi Asset Management’s (BAM) High Income Strategy was up 6.32% at the end of the 3Q. Demand has been buoyed by portfolio rebalancing as stocks touch ever higher valuations and by the double tax-exempt status of municipal issues in high tax states. This rising tide has lifted all municipal boats, including long term bonds issued by the financially challenged State of Illinois – which trade at a 128 basis points spread (1.28%) over the benchmark, the lowest level in 5 years. Will it be smooth sailing in the years beyond? Likely not. And this piece overviews where some risk lies.

The two most evident risks faced by municipal bond investors are credit risk and interest rate risk. Your allocation to municipal bonds is generally meant to protect against the former due to their time-tested resilience to economic cycles, while interest rate risk is an inherent, double-edged sword risk faced by all bond investors. Interest rate risk is two-parted; simply, rates can go higher or lower. A long-term duration (longer term maturities) strategy will suffer should rates move higher (prices lower) and a short-term duration (shorter term maturities) strategy will suffer (in terms of opportunity cost) should rates move lower. Timing these cycles is near impossible and is why we i) generally adhere to the ladder structure to keep you invested and ii) aim to build portfolios customized to your income/asset allocation goals, rather than based on where we/you think the economic cycle is going. We are value managers seeking to capitalize on market inefficiencies. But attempts at market timing – another risk (behavioral investing) faced by all investors – is mitigated by the ladder strategy.

These textbook risks are typically factored in when investors make investment decisions. However, there are two other factors investors need to consider, which are just as vital and have grown in importance due to the change in the bond market landscape over the past ten years.

Investors also need to be cognizant of the:

- investment vehicle their assets are invested in

- negative side effects of low interest rates. Specifically, tight credit spreads and managers going beyond their mandate by reaching for yield (euphemism “yield hunting”)

Risk: Investment Vehicle

We often preach about the benefits of the separately managed account (SMA) in how it enables customization, control, and transparency. It is your own mutual fund, as you own and control the assets within it entirely. Purchases and sales of bonds within the portfolio are at the direction of our portfolio managers based on what we believe is best for your portfolio allocation or due to your personal cash flow/principal needs. We are not forced to sell (or buy) assets within the portfolio when other investors make withdrawals (deposits). Additionally and importantly, an SMA portfolio is not an index fund so what you own is very different than what oftentimes the masses/passive vehicles own.

For example, as of 9/1/2019 the average issue size of each security within our BAM Tactical Ladder composite was $17.3 million. This compares to the iShares MUB ETF where the average issue size of the securities within the fund is nearly $1 billion.[2] Oftentimes we purposely avoid the larger issuers due to tight trading spreads and high market coverage. Often a $5,000,000 local electric utility bond issue provides better value than the $500,000,000 general market deal. Because of their size and for scale purposes, many funds often need to target liquidity rather than yield or credit.

Index funds have grown massively over the past 10 years and often own very similar – if not the same – bond issues. Therefore, holdings are more concentrated than ever. And this dynamic is paired with a shrinking brokerage industry.

What will the bid market look like for these issues if/when a large number of funds need to sell similar holdings simultaneously? Will these investment vehicles offer good liquidity and avoid fire sale price selling in this possible scenario?

With the total number of FINRA-registered firms in decline, (it has decreased from 4,067 in 2014 to 3,607 at the end of 2018, an 11.3% decrease. Over the past 10-years the decrease is nearly 24%.[3]) we would expect to experience a buyers’ market in such a situation. Generally, good for SMA investors, bad for other investors, in our view.

A separately managed account is a way to differentiate from the crowd and protect against a muni bond market sell-off.

Risk: Consequences of a Low Yield Environment

The cause of today’s low yields (compared to “recent” history) can be attributed to a combination of low growth and ultra-easy global central bank policies. Why growth rates are so low and if rates are going to rise is not up for debate here. What is definite though, is that investors’ psychology, investment decisions, and allocations are (re)shaped by low rates.

Low yields and a long-in-the-tooth economic cycle have cued catch phrases such as “reach for yield”, “fixed income alternatives”, “non-transparent ETF”, or “covenant-light” bond issues. All of these pose risk for investors and begs a question: For the “mattress-money” portion of a portfolio, does this mean investors are going outside of the traditional asset allocation or accepting more risk for the same/less yield?

Institutional investors are human, of course and it seems many have succumbed to the urge of reaching for yield. A recent Bloomberg story noted that 30% to 35% of the high yield (i.e. junk) municipal bond market is owned by “high-grade” mutual and exchange traded municipal bond funds. Many fund investors who think they own a high-grade municipal bond fund, actually have 30%-35% of their assets invested in junk rated securities, which may finance economically sensitive and privately backed projects (not essential purpose revenue and/or ad valorem property tax backed). This is clearly a reach for yield and a “mandate creep” on behalf of these fund managers. Unfortunately, many investors are misinformed about what they own.

Dangerously, never have yields been this low and spreads this tight for high yield asset classes. Meaning never have investors lacked so little return compensation for junk rated securities. This statement isn’t an argument against owning such an asset class as part of your overall asset allocation, but more to point out that compensation for owning it is low and – given that such securities are sensitive to the economy or have concentrated risk – they are not high-grade fixed income alternatives.

Why give in to low yields? You cannot have your cake and eat it too!

We understand yields are low, but they are low for a reason. The 15-year AA rated benchmark currently is priced at 1.89%, or a TEY (taxable equivalent yield) of 3.00% at the 37% tax bracket. Given the 30-year treasury is 2.33% and 2x as long, municipal yields are an attractive high-grade asset class. Though these yields are understandably lower than what many retired investors envisioned for income levels 5-10 years ago.

But we must realize these low nominal yields are a reflection of the tax-exempt status and very healthy underlying fiscal dynamics across the average municipality. Tax revenues are growing, pension reform is taking hold in many localities, and rainy day funds are higher (as a %) than they were pre-crisis.

In fact, according to Moody’s: More state and local governments were upgraded in the third quarter than were downgraded, marking the ninth consecutive quarter of such a trend.

You could argue municipal credit is on better footing than it ever has been. Hence yields are low, demand high, and the importance of owning municipals for your “mattress-money” allocation still extremely appropriate.

Happy Holidays and almost New Year from all of us here at Bernardi Securities and Bernardi Asset Management!

Sincerely,

Matt Bernardi

December 30, 2019

****************************************

[1] Source: Bloomberg.

[2] Source: Bernardi Asset Management & Bloomberg

[3] Source: https://www.finra.org/sites/default/files/2019%20Industry%20Snapshot.pdf