37 YEARS

of serving Investors, Issuers, and the Municipal Bond Market

THANK YOU. We wish you and your family a healthy and prosperous 2022 and offer our profound “thank you” for your continued confidence in the Bernardi team. We greatly appreciate the opportunity to help you, your family, organization, community, and constituents.

September 30, 2021 marked the close of our 37th year.

It was another successful and prosperous year for our clients and, therefore, the entire Bernardi Securities team. A highlight for us was our relocation over Memorial Day weekend into our beautiful, new headquarters located in Northfield, Illinois.

MUNICIPAL BONDS BUILD AMERICA’S INFRASTRUCTURE

The municipal bond market has existed for more than 100 years. It is dynamic, developing, and efficient.

And it fundamentally affects how our economy runs and the quality of life in our communities. For the past thirty-seven years we have focused our expertise and efforts on the municipal bond market. Thousands of communities across the country have allowed us to help them raise low cost capital for infrastructure projects their constituents want, need, and can afford.

For nearly four decades, our investors have provided billions of dollars in capital for infrastructure projects across the nation. Projects such as updating existing school facilities, building new schools, town halls, county courthouses, libraries, airports, and recreation facilities. Investors have helped local, county, and state governments fix their roads, bridges, update water and sewer plants, park district and many other facilities.

For the past thirty-seven years individual investors, community banks, family offices, investment advisers, corporations and many other entities have sought our expertise to help invest their capital in quality, public purpose infrastructure projects across our nation.

Since our inception we have relentlessly focused our efforts to help ensure municipal bonds continue to build America’s infrastructure – playing our part at improving lives along the way.

We are gratified to serve in our role and thankful to all who give us the opportunity. We are merely one cog in the machine, but always strive to do our best for those who rely on us.

I thank our loyal clients – both investors and communities across the country – who rely on our team to help navigate the complicated, nuanced municipal bond market.

COVID CONCERNS CONTINUE

In many respects, March 2020 seems a long way off in the rear view mirror and yet Covid protocols remain in place everywhere around us. Our organization continues to successfully adapt our operating policies and procedures. It has been difficult at times, no doubt. But we continue to learn new ways to successfully operate our business serving our clients – without missing a beat.

The pandemic has taught us much about the facets of society and life, its fragility but also our resiliency in dealing with stress and loss. I tend to gravitate to the first line of Hemingway’s passage from A Farewell to Arms (rather than the balance of the excerpt, which is not published here):

“The world breaks everyone and afterward many are strong at the broken places.”

The resiliency of the municipal market has been on full display the past two years, and it has emerged from the crisis a much stronger animal. Largely speaking, most state and local governments quickly reacted and adjusted to the crisis, financially and procedurally so they could continue to govern and provide services in an uncertain and unsafe environment. Traditional revenues that secure bond investors mostly held steady (there were notable exceptions in certain sectors and geographies) and expenses were managed tremendously well, in our view. Federal support was unparalleled helping calm a volatile situation during the initial crisis stage of the pandemic. As important as it initially proved to be, our current analysis points to much of it being largely unnecessary for the average type of credit we invest in. This is a testament to the steady reliability of the municipal bond market as the “mattress money” portion of investment portfolios. On a very positive note, much of the federal money will now serve as a boon for local economies and municipal credit as a whole.

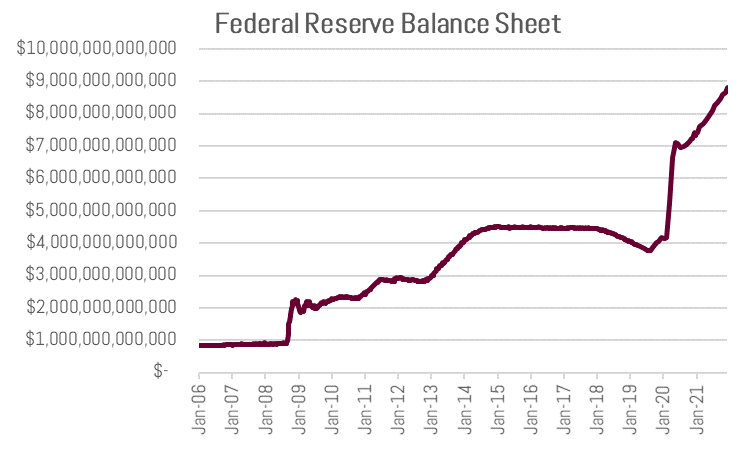

YES, THE FED IS STILL BUYING BONDS

In the coming years we will learn the level of resilience and reliance of the economy to recent Congressional and Federal Reserve stimulus.

Source: Bloomberg

The Fed has begun the process of tapering – reducing the amount of treasury bond and mortgage backed securities it buys each month – and it has indicated this round of quantitative easing will culminate in March/April of next year. Some predict a rate hike around that time and possibly 1-2 more over the course of the year.

The Fed’s latest projections1 anticipate a long term Fed Funds Rate of 2.50%. This compares to 0.00-0.25% today and a dubious 10-year treasury of 1.48%. With high levels of debt and – potentially – society’s dependency on low rates, is the market doubting the targeted future Fed Funds Rate of 2.50%? Many are wondering just how high yields can march before causing economic harm, overall.

What we do have confidence in transpiring during the coming year are higher levels of equity and fixed income market volatility given the removal of a huge provider of daily liquidity. Bank of America’s MOVE Index – which measures bond market volatility – has been moving higher over the course of this year and is nearing a 5-year (excluding the COVID crisis) high. On December 3rd, the CBOE Volatility Index (VIX), a popular measure of stock market volatility, hit its highest level since January 2020 and the S&P 500 Index moved more than 1% for five straight sessions, the longest streak since November 2020. As the Fed begins to taper, financial market volatility will continue.2

We view volatility as an opportunity for our investors and it is an environment we welcome following years of muted bond market volatility. Our clients’ municipal exposure will act as the ballast of their portfolio should equity volatility persist. We have seen this dynamic play out time and time again over the years. The most recent example during the March 2020 COVID sell off. Additionally, the laddered portfolio structure, coupled with owning non-benchmark securities, has proven a successful strategy to insulate bond portfolios against market volatility. The latter are relatively immune from mutual fund induced sell-offs and typically offer higher yields at the time of purchase due to their small-to-mid-size issuances.

This strategy and security selection has worked very well for 37-years, and we expect 2022 to play out similarly.

We thank you again for your confidence in our team and wish everyone a happy, healthy, and resilient new year!

Sincerely,

December 30, 2021

[1] Source: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20211215.pdf

[2] Source: Bloomberg