Market Update: June 30, 2016

We have provided some color about the current state of the bond market below:

Worldwide interest rates have declined in the aftermath of the Brexit vote. The bond market rally continued through Monday, June 27th, with the taxable 10-year U.S. Treasury yield declining to 1.43%.

The process of the UK leaving the EU will take time. This will create uncertainty and therefore, volatility in the financial markets. We do not expect interest rates to increase dramatically in the short term, absent an extraordinary macro event.

In this type of environment, the laddered bond portfolio structure is a sound investment strategy:

– Its fundamental discipline requires re-investment of maturing bond proceeds and interest payments

– Its staggered maturity structure and consistent interest payment dynamic ensures a degree of portfolio liquidity, as funds are regularly available for reinvestment.

– The strategy allows you to capture higher yields on the long end of the ladder.

A derivative strategy many of our portfolio managed clients are using in this low rate environment is our “Short Duration” strategy. This strategy invests assets in shorter term issues currently earning between 0.50% to 1.00% yields not subject to current federal income taxes. These yields approximate to taxable equivalent yields of 0.82% and 1.65% for a taxpayer in the top federal income tax bracket.

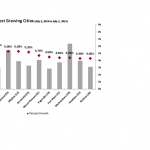

Municipal bonds continue to look attractive compared to other traditional safe haven investments, given recent stock market volatility and continued easy monetary policy around the world. A recent Bloomberg Municipal Market Brief confirms the sentiment:

“The muni market looks attractive and considerably safer,” said Frank Shafroth, the director of the Center for State and Local Leadership at George Mason University in Fairfax, Virginia. “Safe and trusted”.

Please call your Investment Specialist or Portfolio Manager with any questions.

Thank you for your continued confidence in our portfolio management team.

Sincerely,

Thomas P. Bernardi, CFA