Muni Bonds Continue to Provide Stability in an Uncertain Market

According to the ICI Institute, municipal bond fund inflows amounted to $857 million for data ending February 24th.[1] This is now twenty-one straight weeks of inflows into municipal bond funds and we are on pace to see the highest annual inflows since 2012. Our firm’s separate account platform is experiencing a similar trend since 4Q15. This flight to quality corresponds to widespread fears of a global slowdown and a potential recession in the U.S. Since the start of this year, the 10-year AA rated municipal bond has fallen in yield (increased in price) from 2.12% to 1.92% today. The 10-year Treasury has fallen from 2.27% to 1.77%.

The flock to high-grade asset classes has largely left corporate bonds by the wayside, as investors consider the massive amount of issuance post-crisis and fear declining profitability metrics going forward. Pressure in the high yield market has spread beyond the distressed oil sector, as well.

We will not dare to speculate if the trend lower will continue, or if this is merely a hiccup in today’s QE-crazed world. We do believe, however, even with the rally in municipals (lower-yields), and spread widening in corporate bonds (higher yields), municipals continue to offer attractive risk-adjusted returns and should continue to play the foundational “mattress-money” role of your overall asset allocation.

Municipals compare favorably on a taxable equivalent basis with similarly rated corporates in the highest income tax-brackets. When you take into account the overall credit health of the high-grade municipal market and much lower historical default rates versus corporates, municipals continue to offer attractive risk-adjusted taxable equivalent returns for investors in the 25-30% income tax brackets, as well.

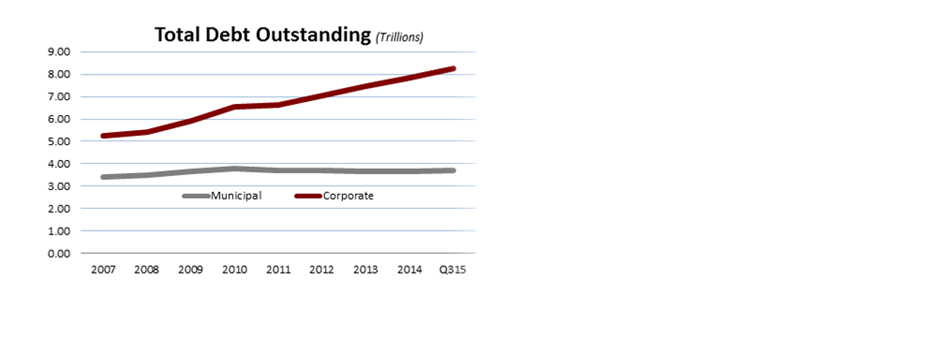

Corporations have certainly taken advantage of the low-rate environment since the crisis. Bond issuance has skyrocketed. Total corporate par-amount outstanding has grown from $5.25 trillion at the end of 2007 to $8.24 trillion as of 3Q15.[2] This is a growth of 56.97%. This compares to our nominal GDP growth since 2007 of only 23.90%.[3] Municipal issuance, on the other hand, has flat-lined, as many localities have conservatively balanced their books and reduced debt in this low-growth environment. The total par-amount outstanding for municipalities is up only slightly since 2007, going from $3.42 trillion to $3.71 trillion 3Q15.

We will admit the low nominal yields in today’s high-grade markets are frustrating. In many ways it seems investors are buying bonds for two reasons… for consistent cash flows and as insurance given the volatility throughout global asset classes and prices (disinflation/deflation). The low relative yields, however, are a testament to the health of the average municipality and investors’ concerns about other credit markets.

I hope you find this commentary helpful and if you have any comments or questions, please do not hesitate to contact your Investment Specialist or Portfolio Manager.

Sincerely,

Matthew P. Bernardi

Investment Specialist

[1] https://www.ici.org/

[2] http://www.sifma.org/research/statistics.aspx

[3] http://www.bea.gov/national/index.htm#gdp