Municipal Market Minefield Maneuvering in Perspective

Last month I was invited to participate in an hour-long discussion hosted and aired live by InvestmentNews, Muni Markets: Maneuvering Through the Minefield. The content was wide-ranging and lively. Over the past few years, we have written about a number of the topics discussed, while other issues covered by the group offered new material to our ongoing discussion and musings on today’s municipal bond market. I want to share some of the highlights of the conversation along with a few follow up thoughts.

All municipal bonds are not created equal

“….we are continuously surprised to find the general attitude among certain municipal bond investors that all bonds are really the same and that certainly all “AAA” rated issues are equal. The belief that an insurance policy on a bond issue somehow creates a municipal bond commodity that should be valued uniformly is wrong”, as we highlighted twelve years ago in our Fall 2000 market update.

For those of you that have a long history with us, you have heard variations on the above theme, ad nauseam. The two co-panelists took time during the early part of the discussion sharing their insights on insured bonds and agreeing with what we wrote in 2000. We believe the diverse and fragmented nature of the municipal bond market is an immutable fact and one of its real credit strengths. Municipal bonds are not and never were homogenous assets. Attempts to create uniformity are misguided, in our view.

Historically, in a normally functioning market, issuer diversity allows sound credits access to capital at an affordable rate, while providing lesser credits access to the market at an appropriately higher borrowing rate. Certain below average credits may temporarily lose access to the market until finances are stabilized. We believe the presence of this dynamic is a primary reason for the historically low default rate of public purpose, essential service municipal bond issues. We believe any force — including municipal bond insurance and a federal guarantee of municipal bonds — that significantly blurs or masks the diversity of underlying credit quality of issuers is a big, fat red herring.

The illusion of credit homogeneity is bad for the investing public and should be viewed warily. In many ways, the present day insured bond market functions as it originally did in the early 1970s. It provides average and below average issuers with wider market access to investors at a reasonable cost — and provides investors with a heightened level of security for these credits. Stellar stand-alone credits eschew the insurance option almost universally.

Today, since the market no longer views all insured bonds as part of one credit continuum, yield disparities exist across the insured market and investors typically earn different returns from insured bonds. This was generally not the case prior to the collapse of the insured market in 2008-2009.

The portfolio management process starts with credit research

This has been a Bernardi mantra for many years. The specifics of each credit are largely what matters and serve as a centerpiece of our portfolio management process. The panel discussed at great length the importance of bottom up credit analysis as well as some of the nuances of a proper municipal credit research process.

At Bernardi Securities, credits do not qualify for our approved list and issues are not underwritten until the underlying credit quality meets the standards of our credit committee. Analysis of the issuer’s underlying credit quality is required. Oftentimes, a look at an issuer’s P&L and balance sheet is needed in order to gain an insightful understanding of the strengths and weaknesses of a particular issue. Ratings and insurance policies are helpful credit metrics, but the analysis does not stop there. We find this deeper understanding of a credit also helps us in properly bidding or pricing the security.

The panel also touched upon the differing role a host county or state government may play in determining the strength or weakness of an issuer. I pointed out the hands-off policy the state of California adopted towards the recent California municipal bankruptcy filings as a “credit negative.” To us, it is a notable, Bill Engvall “there’s your sign” moment when the state of California stands by and allows three of its municipalities to file for bankruptcy as they disavow legal and financial commitments to secured bondholders.

We contrast this laissez-faire approach with the more proactive approaches of state governments in Michigan, Pennsylvania and Rhode Island when confronted with similar situations. The actions taken in 2010 by Rhode Island’s state legislature (Fiscal Stability Act) assisted Central Falls in its Chapter 9 filing and protected secured bondholders, as did last year’s law — giving bondholders priority lien on property taxes and general fund revenues in any Chapter 9 filing. These actions are notable and significant “credit positives” for bond investors. We are not attorneys so we won’t waste our time or energy arguing whether Golden State statutes allow or prevent the state of California from acting similarly. We will simply look for other places to invest our client’s money until we see some clarity on secured bondholders senior lien status — an issue that is crystal clear in our minds.

There is much talk in Washington these days amongst legislators and regulators about improving liquidity in the municipal bond market. Market liquidity has improved greatly over the 32 years I have been in this business. Improved liquidity is good for investors and issuers. It lowers borrowing costs for most issuers of municipal bonds.

The recent improvements in liquidity, however, will be compromised if sovereign state governments sit idly by and allow local units of government to disavow their financial obligations to secured bondholders. Any uncertainty or loss of trust in how the system will behave can cause an adverse reaction amongst investors. This potential development hurts everyone and needs to be met head on. Legislators and regulators could help in spreading the message to state and local governments to avoid this scenario and intervene when prudent.

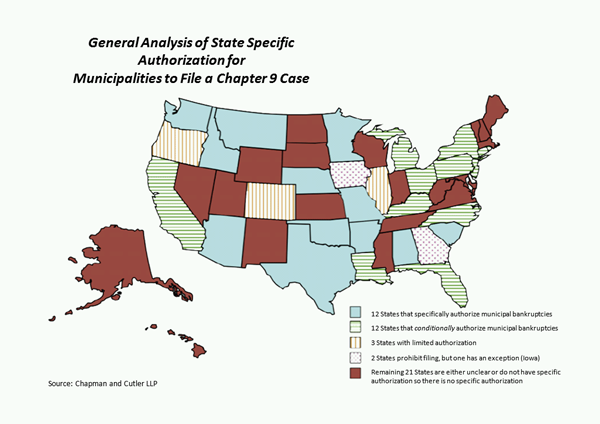

The chart below summarizes the differing approaches state law takes in regard to Chapter 9 filings. These state variances oftentimes help shape our view — positive and negative — regarding a specific issuer’s credit quality.

An audience question we didn’t have time to get to, but worth taking the time to answer here was “Thoughts on Illinois?” Well, we have many, many thoughts on Illinois given we reside here and are incorporated in this great state. Illinois clearly has its share of problems as underscored by the recent Standard and Poor’s rating downgrade to “A” (negative outlook) from “A+”. We believe the state’s low pension funding level of approximately 45%, coupled with a lack of political will among the legislature to solve the underfunding problem were the primary factors responsible for the downgrade. The special, one-day legislative session convened by the governor last month did not solve the pension issue and appears to have accomplished very little, if anything at all. No measures to address the pension problem were approved by lawmakers during this session.

There are a number of proposed solutions that have been aired, including increasing employee contributions and requiring local school districts to cover pension costs. None have gained sufficient traction amongst legislators at this point in time. Additionally, continued structural deficits persist despite last year’s income tax increases, which are set to expire on January 1, 2015.

Putting these significant problems aside for a moment, there has been some positive news regarding the State of Illinois economy. A report recently released by the Illinois Municipal League cited the following positive developments:

- Per capita LGDF distribution up 4.5% — In fiscal 2012 (May 2011- April 30, 2012), per capita distribution of Local Government Distributive Fund (LGDF) was $81.44 which was a 4.5% increase over the prior year’s distribution. LGDF is distributed to municipalities and counties on a per capita basis and represents income tax receipts collected statewide.

- Expected to grow another 2-2.5% this year — Current year LGDF distributions are expected to exceed last year’s payments by approximately 2%-2.5%.

- Out-of-state use tax distributions up more than 7% — Distributions to local governments of the Illinois use tax on out-of-state purchases increased by over 7% last fiscal year compared to a year earlier.

Willingness versus ability to pay

I found this part of our discussion both fascinating and frustrating. Fascinating in that, as panelist Stephen Winterstein correctly stated, today there are handful of issuers that have chosen not to pay secured debtholders in spite of the fact dedicated revenue streams are sufficient to honor certain debt commitments. We discussed the possibility that certain issuers seem to be using bankruptcy and default as a financial tool.

In the past, defaults have occurred mostly because projects failed financially. For example, revenues from a project were insufficient to cover debt service or taxes collected were insufficient to cover debt service. Today, in a limited number of instances, a sufficient, secured source of revenue exists, and is pledged to a specific debt issue payments — yet elected officials choose to use these funds for other purposes to satisfy another need and constituency. This unwillingness to pay is not a new phenomenon, but it certainly appears to be more widely accepted today than in the past. The issue of political will is a frustrating and worrisome development.

We wrote on the topic in our June market commentary and more recently in our 2012 Mid-Year Municipal Market & Credit Update. Admittedly, determining issuer willingness to pay is difficult as it is mostly an intangible concept. But there is some art to this science and decades of experience and municipal market specialization has taught us a few things, which we often incorporate into our credit research process.

There are some positive signs and trends on this issue. San Bernardino, California recently reversed itself when it filed its budget plan to pay for city services during its bankruptcy proceedings. The current plan includes debt service payments for its outstanding general obligation pension bonds. Previously, when the city adopted an emergency budget before filing for bankruptcy, its plan excluded such payments.

Warren Buffett’s municipal bond sale was just a trade

The panel was asked about Berkshire Hathaway’s recent termination of $8.25 billion in credit default swaps representing approximately one half of its exposure. The group briefly discussed the topic and agreed it did not view the Berkshire bond sale as a signal it expects massive municipal bond defaults or bankruptcies. InvestmentNews summarized this discussion in the article Buffett’s muni sale no cause for concern, experts say. We at Bernardi view it as a trade. Mr. Buffett is a very smart man and was astute enough to underwrite insurance against municipal defaults back in 2008 and he’s paid out very little. We suspect he’s made a lot of money on that trade. We don’t necessarily conclude he sold because he’s concerned about massive defaults in the muni market. As William Shakespeare said — and we often quote — “Sell when you can; you are not for all markets.”

We have no illusions that more municipal bankruptcies and defaults lie ahead, because there are significant credit problems remaining in many places across the country. Certain issuers will successfully navigate through these difficult times, others will not. Keep in mind bankruptcy does not necessarily equal bond default, and similarly, bond default does not necessarily lead to bankruptcy.

Municipal transparency imperative lost in the Whitney hype

In her oft-referenced 60 Minutes interview on December 19, 2010, Meredith Whitney claimed, “You could see 50 sizable defaults. 50 to 100 sizeable defaults. More. This will amount to hundreds of billions of dollars worth of defaults.” When asked about this statement, our group discussed it briefly citing the obvious. Clearly, these events did not occur in 2011 as predicted by Ms. Whitney.

To me, however, her missed clarion call was helpful for two reasons:

- Strained state and local government finances received needed attention – Additional attention was brought to the generally strained financial condition of many state and local governments, forcing elected officials to begin to deal with structural budget imbalances. Certain issuers have responded in a positive fashion and many others have not.

- Better municipal disclosure is truly needed – Lost in the hullabaloo surrounding her commentary was the observation regarding the lack of transparency in the municipal marketplace and the need for better financial disclosure practices.

The need for improved and timelier municipal disclosure has been a theme of ours for years and good progress has been made recently. Between July 2009 and June 2012, the Municipal Securities Rulemaking Board (MSRB) received 396,091 continuing disclosure documents with 139,043 submissions in the most recent 12-month period. During this three-year period, approximately 53% of the submissions were for event disclosures and 47% were financial and operating disclosures. Lastly, on a month-to-month basis, the number of continuing disclosures received by the MSRB has generally increased since it began collecting documents. This is remarkable progress in a short period of time.

Another audience question revolved around the quality of this information, it’s timeliness and completeness. Generally, we find the quality of information available in audited financial statements is very good and complete. We also find that when we take the time to telephone an issuer or its auditor to inquire about an item in their audit, parties are generally responsive and helpful in answering our questions. Timeliness of filings remains a problem in too many cases.

Continuing improvements in this disclosure area are needed, and when they are implemented will greatly increase market efficiency for issuers and investors. The SEC released an extensive report on July 31, 2012 entitled “Report on the Municipal Securities Market.” A section of the report focuses on improving issuer disclosure practices. It offers several legislative considerations in order to provide the Commission the authority to improve disclosure practices:

- Authorize the Commission to require municipal issuers prepare and disseminate official statements and disclosure during the outstanding term of the securities, including timeframes, frequency for such dissemination and minimum disclosure requirements,

- Authorize the Commission to establish the form and content of financial statements for municipal issuers who issue municipal securities, including the authority to recognize the standards of a designated private-sector body as generally accepted for purposes of the federal securities law, and provide the Commission with attendant authority over such private-sector body.

- To provide a mechanism to enforce compliance with continuing disclosure agreements and other obligations of municipal issuers to protect securities bondholders, authorize the Commission to require trustees or other entities to enforce the terms of continuing disclosure agreements.

There exists a wide gap between the recommendations cited in the report and the reality of what changes can be actually put into place. Suffice it to say, additional regulatory changes are coming to the municipal bond marketplace.

The bedrock for local government funding

The market today is far different from what it looked like a few short years ago. Compared to the marketplace of 1980, when my career began, it has evolved and become a more complex, vastly improved marketplace for both investors and issuers. Additional improvements are needed and certainly will occur. A major overhaul of the marketplace would be a serious misstep and create havoc for issuers, adding to the already high degree of investor uncertainty that pervades today’s financial markets. As SEC Chairman Mary Schapiro has pointed out, “The municipal securities market is the bedrock for funding of local government projects throughout our country.”

The municipal bond market has held up surprisingly well since the 2008-2009 financial crisis. Bond issuance and investor demand levels rebounded nicely following the dramatic declines in the fall of 2008 and spring of 2009. Generally, municipal bond yields today — although low by recent historical standards — offer attractive value relative to U.S. Treasury, certificate of deposit and highly rated corporate bond yields. In recent years, annual total return performance numbers for municipal bond portfolios have compared favorably to other asset classes. The market has evolved nicely since the fall of 2008.

What bonds do we like?

During the panel discussion we were asked, “What areas of the municipal market do you like today?” Our response, as always, was that we prefer investing in safe sector, public purpose municipal bond issues — issues that demonstrate sound underlying credit quality, essential public purpose nature and solid deal structure characteristics.

We have found over several decades, these types of issues have performed very well for our clients’ bond portfolios. Our preference for these municipal bond sectors has been emboldened as issues with these features generally weathered the 2008-2009 financial crisis.

Sincerely,

Ronald P. Bernardi

President/CEO

Bernardi Securities, Inc.

September 14, 2012