Perspective for Advisors | Tax Loss Swap into a SMA

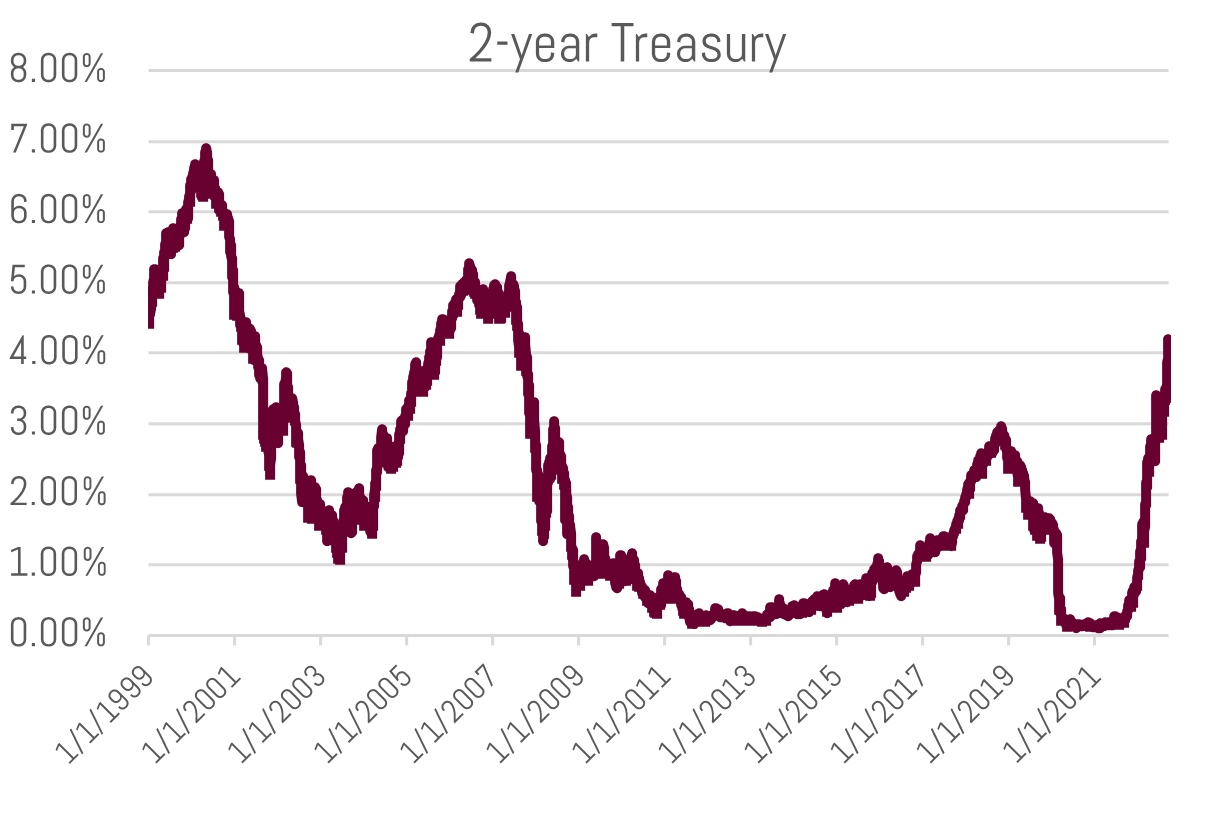

The market rout of 2022 has left few asset classes unscathed. The S&P 500 is down 22.51% through 9/23. While bonds have not been immune given the Fed’s 180 degree policy turn from late 2021 and persistent inflationary pressures. The 2-year treasury’s steep rise is a sharp representation of how quickly the Fed transformed from dovish to hawkish.

The Bloomberg Global-Aggregate Bond Index[1] is down 19.30% through 9/23. Municipals have held up relatively well as the Bloomberg Municipal Bond Index[2] is down 11.28% YTD. High yield and higher duration municipal strategies have fared worse given positioning in longer maturities, lower credit, or the use of leverage.

Now is an opportune time to take advantage of tax loss swaps and, potentially, swap into a separately managed account strategy away from fixed income mutual funds and ETFs. This likely will reduce your clients’ tax burden and enhance their municipal bond investment vehicle.

Bernardi Asset Management separate account strategy composites have fared relatively well this year. The Tactical Ladder Municipal Composite (15-year ladder) was down 6.45% through 6/30, while the High Income Municipal Composite (minimum yield target) was down 7.74% through 6/30. For comparison’s sake, the Bloomberg Muni Index was down 8.98% through 6/30.

| Last 4 Hiking Cycles | 2-Year Yield Change | Days |

| Dec 2021 – Sept 2022 | 3.54% | 282 |

| Sept. 2016 – Dec 2018 | 1.92% | 825 |

| April 2004 – June 2006 | 3.53% | 820 |

| April 1999 – May 2000 | 1.90% | 412 |

A separate account municipal bond portfolio enables:

- Control of assets – when to buy, sell, and take advantage of tax losses (or not at all)

- Transparency of holdings – when the portfolio cash flows and oncoming maturities

- Customization – geographic concentration, sector, and credit allocation

The separate account portfolio benefits significantly from these three facets, especially in environments like today. A separate account employing a hold-to-maturity strategy, experiences losses “on paper.”

Losses are not realized unless you want to lock them in. Over time, given successful credit selection, bonds will mature at par and our ladders roll forward into higher yields. The simplicity of this investment vehicle and strategy reduces volatility and the potential for losses.

That said, tax loss swaps are an excellent strategy to reduce one’s overall tax burden and add long term value to the portfolio. Furthermore, you can kill two birds (dove and a hawk) with swapping into a customized separate account strategy.

Please reach out to your Investment Specialist or Portfolio Manager if you have any questions about your portfolio or our approach to municipal bond portfolio management.

[1] Source: Bloomberg, LEGATRUU Index

[2] Source: Bloomberg, LMBITR Index

****

Bernardi Asset Management, LLC (BAM) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. BAM has been independently verified for the periods 01/01/2013 through 12/31/2020. The verification report(s) are available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firmwide basis. Verification does not provide assurance on the accuracy of any specific performance report. Bernardi Asset Management, LLC (“BAM”) is a registered investment adviser with United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. BAM began managing assets in February 2000. The firm’s list of composite descriptions is available upon request. Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Past performance is not indicative of future results.

The U.S. Dollar is the currency used to express performance. Returns are presented net of fees and include the reinvestment of all income. Net returns are reduced by all actual fees and transaction costs incurred. The annual composite dispersion presented is an asset-weighted standard deviation calculated for the accounts in the composite the entire year using net returns. Policies for valuing investments, calculating performance, and creating GIPS Reports are available upon request. The investment management fee schedule for the composite is 0.40% for accounts $2 million or smaller, 0.35% for accounts between $2-5 million,0.30% for accounts between $5-10 million, 0.25% for accounts between $10-15 million, and 0.20% for accounts over $15 million. Actual investment advisory fees incurred by clients may vary. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

APPENDIX – HIGH INCOME MUNICIPAL COMPOSITE

| Year

End |

Total Firm Assets (millions) | Composite Assets

(USD) (millions) |

Number of Accounts | Annual Performance Results Composite (net of fees) | Bloomberg Barclays Municipal Bond 15-Year (12-17) Index | Dispersion | Composite 3-yr

St Dev |

Benchmark

3-yr St Dev |

| 2021 | 229.11 | 15.76 | 6 | 0.91% | 1.91% | 0.27% | 2.88% | 4.86% |

| 2020 | 196.85 | 15.63 | ≤5 | 5.20% | 6.32% | N/A2 | 3.39% | 4.90% |

| 2019 | 176.40 | 15.06 | ≤5 | 6.75% | 8.90% | N/A2 | 2.83% | 3.08% |

| 2018 | 176.47 | 8.64 | ≤5 | 0.43% | 1.38% | N/A2 | 4.21% | 4.31% |

| 2017 | 159.10 | 6.98 | ≤5 | 5.45% | 6.94% | N/A2 | 3.80% | 4.21% |

| 2016 | 142.96 | 6.22 | ≤5 | -0.43% | 0.34% | N/A2 | 3.86% | 4.33% |

| 2015 | 138.14 | 4.48 | ≤5 | 3.78% | 4.00% | N/A2 | 3.10% | 4.23% |

| 2014 | 115.62 | 1.68 | ≤5 | 9.60% | 11.73% | N/A2 | N/A1 | N/A1 |

| 2013 | 114.63 | 1.49 | ≤5 | -1.07% | -3.32% | N/A2 | N/A1 | N/A1 |

N/A1 – The three-year annualized standard deviation measures the variability of the composite and the benchmark returns over the preceding 36-month period using net returns. The three-year annualized standard deviation is not presented due to less than 36 months of composite and benchmark data.

N/A2 – There are an insufficient number of portfolios for the entire year to calculate composite dispersion.

High Income Municipal Composite is comprised of fully discretionary, separately managed account (SMA) portfolios. Composite portfolios hold individual bonds, primarily consisting of investment grade issues, which seek high income through higher duration portfolios and for comparison purposes is measured against the Bloomberg Barclays Municipal Bond 15-Year (12-17) Index. The Bloomberg Barclays Municipal Bond 15-Year (12-17) Index is an unmanaged index of municipal bonds traded in the U.S. with maturities ranging from 12-17 years. The composite was created January 01, 2013. The composite inception date is January 01, 2013. The minimum account size for inclusion in the composite is $250,000.

APPENDIX – TACTICAL LADDER MUNICIPAL COMPOSITE

| Year

End |

Total Firm Assets (millions) | Composite Assets

(USD) (millions) |

Number of Accounts | Annual Performance Results Composite (net of fees) | Bloomberg Barclays Muni Short/Int (1-10) Index | Dispersion | Composite 3-yr

St Dev |

Benchmark

3-yr St Dev |

| 2021 | 229.11 | 84.73 | 28 | 0.54% | 0.43% | 0.39% | 2.23% | 2.58% |

| 2020 | 196.85 | 65.51 | 19 | 4.36% | 3.97% | 0.38% | 2.20% | 2.60% |

| 2019 | 176.40 | 42.37 | 16 | 4.79% | 5.23% | 0.28% | 1.63% | 1.78% |

| 2018 | 176.48 | 54.00 | 17 | 1.32% | 1.69% | 0.20% | 2.04% | 2.31% |

| 2017 | 159.10 | 54.52 | 18 | 2.58% | 3.03% | 0.33% | 1.92% | 2.30% |

| 2016 | 142.96 | 52.76 | 18 | 0.07% | -0.15% | 0.33% | 1.91% | 2.19% |

| 2015 | 138.14 | 44.75 | 15 | 2.02% | 2.20% | 0.26% | 1.76% | 1.89% |

| 2014 | 115.62 | 50.22 | 16 | 3.75% | 3.85% | 0.75% | N/A1 | N/A1 |

| 2013 | 114.63 | 56.74 | 15 | -0.14% | 0.02% | 0.39% | N/A1 | N/A1 |

N/A1 – The three-year annualized standard deviation measures the variability of the composite and the benchmark returns over the preceding 36-month period using net returns. The three-year annualized standard deviation is not presented due to less than 36 months of composite and benchmark data.

Tactical Ladder Municipal Composite is comprised fully discretionary, separately managed account (SMA) portfolios. The composite contains portfolios holding mostly tax-free municipal bonds and for comparison purposes is measured against the Bloomberg Barclays Municipal Short/Intermediate (1-10) Index. The Bloomberg Barclays Municipal Short/Intermediate (1-10) Index is a market-value-weighted index that includes investment grade tax-exempt bonds with maturities of one to ten years. The composite was created January 01, 2013. The composite inception date is January 01, 2013. The minimum account size for inclusion in the composite is $250,000. An incorrect amount was previously used for number of account (2019 & 2020). These errors were due to a change in software provider for the firm’s performance reporting and composite management.