The past year and half presented many challenges, but also a multitude of silver-linings and learning experiences. Within the municipal bond market, the experience verified the sector’s overall creditworthy reputation and balance sheet sturdiness. Federal monetary and fiscal policy intervention certainly have helped, though most states projected balanced budgets prior to the latest round of direct fiscal aid.[1] Furthermore, prior to the sharp economic recovery – catalyzed by reopening, Federal aid, and loose monetary policy – most states and localities were dealing with the crisis in stride through job cuts, project delays, draws on cash reserves, debt refinancing, and other fiscal levers. This experience should be comforting to municipal bond investors as the asset class served its primary purpose of principal preservation – largely without extraordinary federal intervention.

Given the nature of the crisis, federal stimulus actions have been unprecedented. The Federal Reserve’s balance sheet now amounts to over $8 trillion, and we are expected to run a federal budget deficit of over $3 trillion for the second year in a row. This intervention from D.C. has generally impacted the municipal market in two ways:

- For the healthiest issuers and those best prepared for the crisis, it strengthened their balance sheets and underlying revenue sources to a level where many credits are better situated today than they were before the crisis.

- It has temporarily bridged the gap for credits that are either i) structurally imbalanced (those that have high fixed costs; e.g. pensions) or those that ii) experienced significant revenue shortfalls as a result of the pandemic (e.g. NYC public transit). For many of these types of issuers, the day of reckoning has simply been delayed and medium-to-long-term credit pressures remain.

Present:

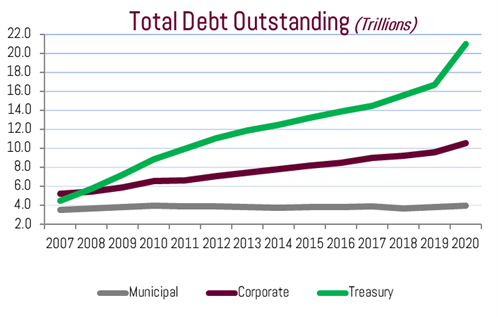

Source: SIFMA

Today’s municipal market is awash in cash, experiencing high levels of demand, and low levels of supply. Sound familiar? Demand is further catalyzed by potential higher tax rates and a very strong credit environment (noted above). In terms of the latter, forty-six states are rated AA- or higher by S&P, while twenty-five are rated AA+ or AAA, which is equal to or better than what S&P rates the US government. If treasury debt continues to mount, an argument could be made for owning municipals vis-à-vis treasuries, as a way to enhance credit.

This technical and fundamental backdrop should lead to a stable market environment for the time being and low muni/treasury ratio levels (low tax-free municipal yields relative to treasury yields). We believe value can be added to portfolios in two major ways:

- Buying kicker bonds (bonds with a short call date and longer maturity) with 3-4% coupons. Coupons above 4% will likely be called, while coupons lower than 3% are subject to higher durations (i.e. volatility).

- Smaller-to-medium sized issuers which do not have broad market coverage nor placement within benchmark indexes. Adding these types of issuers are a way diversify away from the average benchmark and enhance yield.

Additionally, for tax-advantaged accounts, taxable municipal bonds offer value relative to other high-grade fixed income and are a way to enhance yield.

Future:

Quiescent market dynamics could give way for two reasons:

- Change in Monetary Policy: Later this year the Federal Reserve will likely embark on a path of tighter monetary policy and begin the process of unwinding current levels of extraordinary monetary policy support. The first step will be purely rhetorical – not actually doing anything – through the discussion of tapering balance sheet purchases. Currently the Fed buys $120 billion of treasuries and mortgage back securities each month. Tapering these purchases (likely starting with mortgage bonds) will reduce the size of monthly purchases. The actual balance sheet will continue to grow through 2022.

- Infrastructure Bill: The sausage making process is running at full speed in DC today. As part of an infrastructure oriented bill or as separate legislation, Congress may reintroduce Build American Bonds 2.0, similar to the program rolled out during the last crisis. This would directly impact the taxable municipal market, and likely lead to higher supply and higher yields/spreads. Additionally, Congress may allow for municipalities to “advance refund” their debt. This is a refinancing mechanism currently unavailable to issues as a result of the tax reform in 2017. If it is reenabled, this will likely increase tax-exempt municipal supply.

In summary, the municipal bond market remains on solid footing and proved its primary portfolio construction purpose during the travails of 2020. The outlook is favorable as well, though a change in monetary policy may provide opportunities to add exposure and higher yields on resulting market volatility.

[1] The American Recovery Plan was signed into law on March 11, 2021 and allocated $350 billion to state, local, and tribal governments.