End of Easy and its Implications for the Municipal Bond Market

As the Fed publicly discusses it is nearing the end of its emergency approach to the pandemic and begins scaling back its pace of securities purchases, we thought it would be a good time to review the current status of the municipal market and potential outcomes for the 4th quarter.

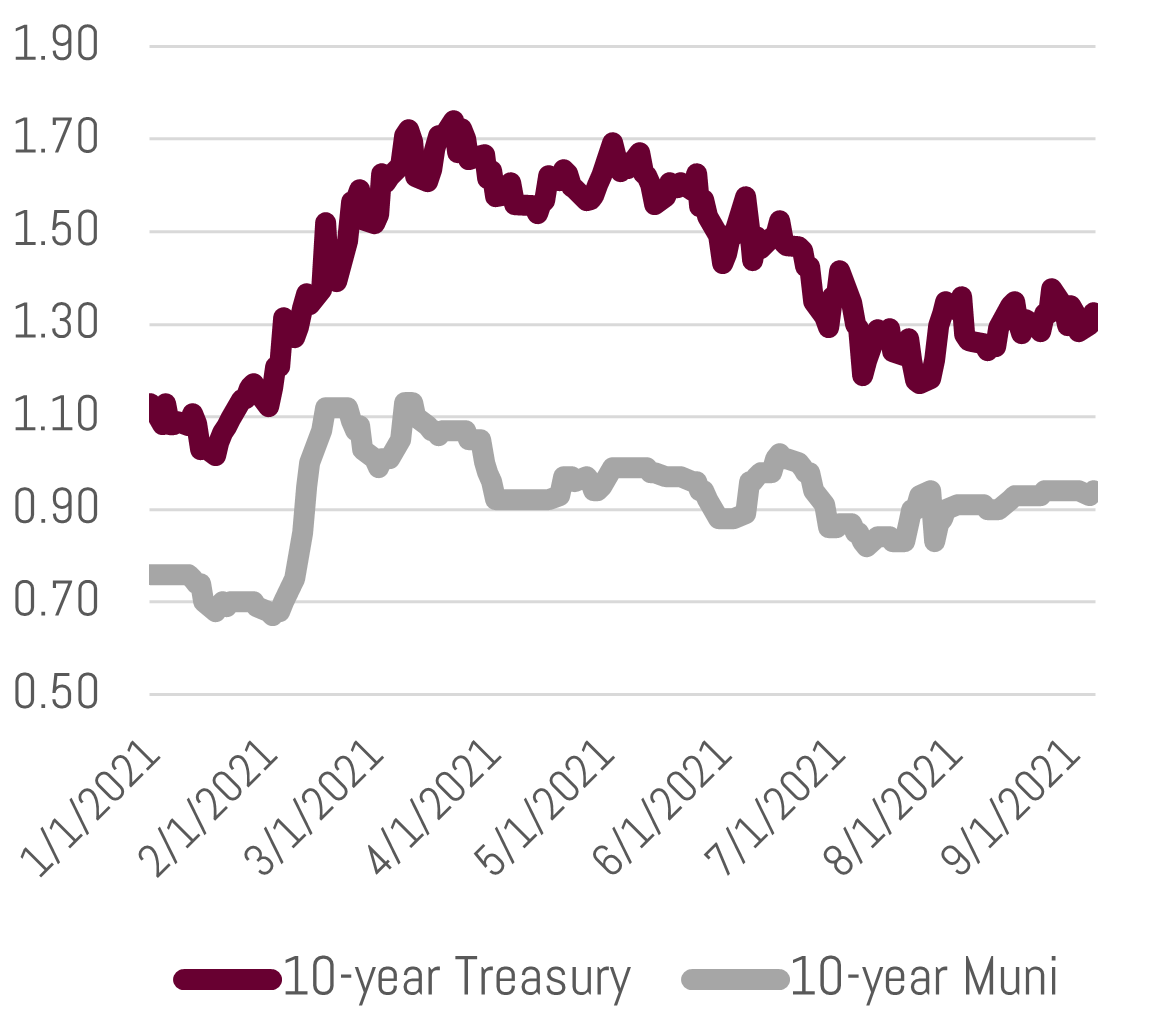

Municipal yields – and bond yields in general – have stagnated since the early spring even though economic growth is robust and inflation readings are high. The market has largely looked through these metrics, as many believe this dynamic will be short-lived. What underpins this stance is the view that growth and inflation metrics are simply boosted by fleeting catalysts such as supply chain bottlenecks and one-time federal stimulus measures. The immense presence of the Fed’s growing balance sheet has served as further support for current market yields, as well.

Municipal yields – and bond yields in general – have stagnated since the early spring even though economic growth is robust and inflation readings are high. The market has largely looked through these metrics, as many believe this dynamic will be short-lived. What underpins this stance is the view that growth and inflation metrics are simply boosted by fleeting catalysts such as supply chain bottlenecks and one-time federal stimulus measures. The immense presence of the Fed’s growing balance sheet has served as further support for current market yields, as well.

Municipal yields have trended sideways since mid-summer. The market has experienced robust demand as many investors rebalance out of the equity market following another year of outsized gains. Muted new issue supply, coupled with expectations for higher tax rates, has swelled demand, as well.

Valuation Outlook

At the moment, the ratio of AAA rated 10-year municipal bond yields (0.94%) relative to the taxable 10-year treasury bond yield (1.32%) sits around 71%. This compares to a pre-COVID crisis level average of 83%. So relative to pre-crisis levels, today’s municipal yields are lower vis-à-vis treasuries. Given the current backdrop mentioned above and very strong underlying credit fundamentals for the majority of state and local governments, we expect the ratio to remain in 70-80% range through year-end.

During the previous Fed tightening cycle, municipal valuations tightened. There were certainly bouts of volatility, but over 6 years the 10-year ratio moved lower from 105% in May of 2013 (when the Taper Tantrum began) to 72% in the period right before the COVID-19 outbreak. During this time, the Fed hiked short-term rates from 0.25% to 2.50% and reduced its balance sheet by $700 billion from its height.[1]

Though valuations may be tight from past history, ample spread is still available across the yield curve for smaller-to-medium sized issuers. For income-oriented investors, we believe portfolios should be overweight these types of solid quality issuers within a separate account structure.

Credit Outlook

Credit security (i.e. principal preservation) is a primary reason for investing in municipals and we forecast continued stability in this metric through the end of the year. That said, due to ongoing concerns about COVID-19, tax revenues may continue to be pressured within certain issuers that are dependent on tourism, urban commercial property, and urban transit. Alternatively, suburban and many non-metro credits will continue to benefit from the millennial generation’s march to the suburbs and their demand for larger housing footprints. These locales will also continue to derive benefits from families working in hybrid work-from-home environments.

Duration Outlook

Duration positioning within the fixed income market – and likely most assets classes in general – will be a very important aspect of portfolio construction over the next 6-12 months. We seek to protect portfolios from excessive duration risk through the ladder maturity structure. This strategy diversifies portfolios across the yield curve while maintaining a conservative average maturity. Additionally, it establishes a level of discipline to stay invested and helps us avoid the mistake of attempting to time the next cycle.

Investors should also take heart in the typical relationship of municipal bond yields to treasury yields, in that they tend not to move in lockstep. Our regression analysis showed that for every 100 basis point (1.00%) increase in the 10-year treasury yield, the mean increase in the 10-year municipal yield was 0.82%, which means municipals are less volatile when compared to treasury bonds.

****

As we enter the 4th quarter of 2021, the Fed’s role continues as the main ingredient in market fluctuations. Overall, we remain optimistic on municipal credit with the essential purpose and essential revenue sectors. We expect current valuations to hold in the current ranges of recent months, though the market could experience higher levels of volatility as the Fed begins stepping off the pedal of its easy monetary policies.

Matt Bernardi

Vice President

Bernardi Securities & Bernardi Asset Management

[1] Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm