Perspective for Advisors: Bonds are Back!

Jerome Powell and his Federal Reserve colleagues have begun taking steps to put the income back in fixed income assets, leading to one of the worst bond market drawdowns in the past forty years. Rates have spiked as the Fed has made a rapid about-face in its monetary policy approach.

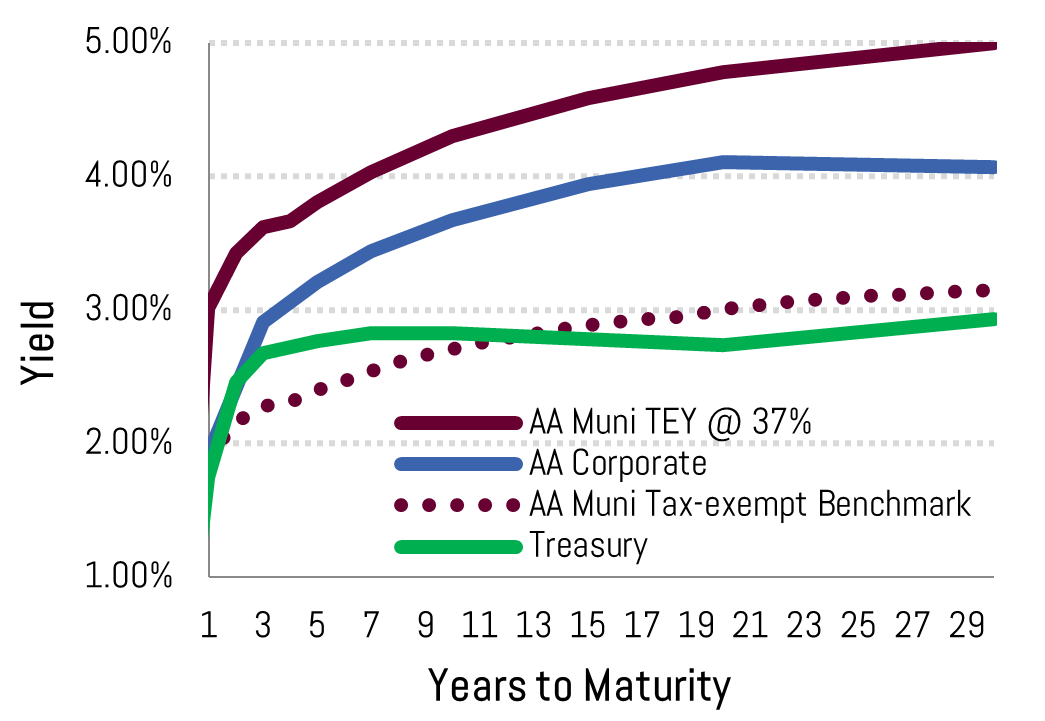

Concurrently, municipal yields are up substantially and offer attractive yields when compared to alternative high-grade fixed income assets. Should the new Fed policy induce a recession, current yield levels of municipals offer significant value in our view – and credit protection, since solid quality credits can weather a soft economy given high cash balances, non-discretionary sources of revenue, and myriad expense cutting capabilities.

Our separately managed account (SMA) portfolios have held up relatively well in this environment – especially versus fund alternatives – and are poised to take advantage of higher yields as our laddered portfolios progress forward.

An important aspect of the SMA structure is that losses remain on paper and can be selectively realized should a portfolio have tax loss needs.[1] Alternatively, a fund may have to forcibly realize losses as outside investors sell.

Today’s average AA rated 10-year municipal yields 2.89% vs. 1.15% at the start of the year. The 10-year treasury (which is taxable) yields 2 basis points less at the time of this writing. If you are in the top four tax brackets (24%, 32%, 35%, 37%) buying the average AA rated muni is like buying a 3.80-4.58% taxable bond.

How We Got Here in Such Short Order

The spike higher in rates we have experienced this year is due to the Fed pulling a 180 degree turn in its approach to monetary policy. Just over a year ago, the Fed was projecting no interest rate increases until 2024.[2]

The Fed is now projecting and communicating:

- An aggressive rate hiking cycle for the next 8 months (see red dotted line on chart below): The market is pricing 9 more hikes through year-end

- A departure from the traditional 25 basis point (0.25%) rate hike increments: There is a high likelihood the Fed will raise rates by 50 basis points (0.50%) at each of the next two meetings (May 4th and June 15th)

- A rapid decrease of the balance sheet, composed of $9 trillion of treasury bonds and mortgage-backed securities, as they aim to sell upwards of $95 billion per month starting in May.

We hope today’s yields stick and we are not in store for a 2018 repeat when the economy slowed before the Fed Funds Rate peaked at 2.50%. The chart below shows that the ISM Manufacturing Index[3] started deteriorating in the summer of 2018, shortly before the culmination of the hiking cycle in December 2018.

The projected path of the Fed Funds Rate through the end of this year matches the level reached in 2018. However, we are expected to get there at a much quicker pace.

We believe the laddered maturity structure, within a separate account is the best way to adapt to these volatile markets. According to our Sharpe Ratio Analysis – which measures risk-adjusted returns – our Tactical Ladder and the High Income strategies have outperformed the benchmarks as of late.

| Bernardi Asset Management Composites vs. Benchmarks | |||

| As of 3/31/2022 | 3-Year Sharpe | Standard Dev. | Mod Duration |

| BAM Tactical Muni | 0.15 | 2.95 | 3.99 |

| Index: BBG Short/Int Muni | 0.13 | 3.17 | 3.43 |

| BAM High Income Muni | 0.33 | 3.46 | 4.25 |

| Index: BBG 15Yr Muni | 0.25 | 5.71 | 5.86 |

The higher the Sharpe Ratio the better. It demonstrates either higher returns and/or a low standard deviation (level of volatility).

We attribute our attractive Sharpe Ratios and returns to a number of factors, including:

- Ladder Maturity Structure: enables ongoing cash flows to reinvest at higher rates. It also keeps portfolio turnover relatively low compared to the “barbell” strategy.

- Small-to-medium-sized issuers: these types of bonds provide two benefits:

1. Higher yields given their smaller issue size/ lower market coverage

2. Lack of presence in benchmarks and large mutual funds.

- Allocation to high-grade credits: we target essential purpose and essential revenue bonds that have demonstrated sturdiness during economic downturns. See our Three Pillars of Credit Analysis

- Allocation to higher yielding, out-of-favor states: we have low weightings to double-exempt (and often low yielding) states such as California and New York for non-CA/NY residents.

| Top State Holdings | 1 | 2 | 3 | 4 | 5 |

| Ultra-Short Strategy | IN | MN | NJ | IA | AZ |

| Short Term Strategy | TX | IN | WI | IA | IL |

| Tactical Ladder Strategy | TX | IN | WI | MI | IL |

| High Income Strategy | TX | MI | IN | IL | KS |

The above has enabled our Tactical Ladder, High Income, and taxable strategies to outperform their benchmark over a 1-year period.

*****

In summary, municipal yields are very attractive relative to recent history and especially other high-grade fixed income assets. The path of rates from here is unknown as we deal with an extremely uncertain future in terms of predicting the pace of inflation and growth. We believe it is best to diversify across the yield curve within the SMA structure.

Please reach out to your Investment Specialist or Portfolio Manager if you would like to discuss our approach and strategies in more detail.

Sincerely,

Matt Bernardi

Vice President

[1] Oftentimes a bond can be sold – tax loss captured – and replaced with a new similar maturity bond that pays higher levels of interest to offset the tax loss and add higher levels of income over the life of the bond.

[2] https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210317.pdf

[3] The ISM Manufacturing Index is a monthly indicator of U.S. economic activity based on a survey of managers at more than 300 manufacturing firms. It is a key indicator of the state of the U.S. economy.