The Magic of 34

January 2018

By Ronald P. Bernardi

The “Magic Square of 34” appears in the upper right side of Albrecht Durer’s 1514 copper plated masterpiece, “Melancholia.” The allegorical work is the subject of many interpretations. One interpretation asserts the scene depicts the age of Humanism, both its creative successes and unsolved frustrations.

Setting aside the questions evoked by the work, Durer’s magic square is its constant: the sum of 34 is found in the rows, columns and diagonals, the four corner numbers and the four center squares.

Year number 34 for Bernardi Securities began on October 1, 2017. Over these years we have enjoyed some great successes and experienced some frustrating uncertainties reminiscent of underlying themes of Durer’s “Melancholia.”

Like Durer’s magic square constant, there are certain Bernardi Constants our clients rely on and appreciate:

- Specialization and market expertise

- Ongoing awareness of client needs and forward thinking in order to serve better

- Organizational integrity resulting in an exemplary regulatory record

- Efficient and transparent cost structure

- Above average client performance and impeccable service

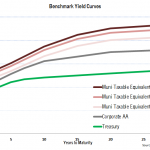

Our value-oriented strategy enables us to outperform often and is based on properly identifying and pricing risk. Market price is a reflection of future value discounted at a certain risk-based rate. “Where is the risk? Is the market correctly or incorrectly pricing the risk?” These are the two questions at the heart of our value strategy. In the answers lies the opportunity for clients.

We are grateful to our clients, friends, and partners who have helped make all of the above happen for nearly three and one half decades. Thank you for your continued confidence in our team and process.

*****

A HIGHLY REGULATED, LESS LIQUID BOND MARKET AND POSSIBLE INVESTOR VULNERABILITIES IN 2018

In recent years, new rulemaking affecting our industry has been prodigious. Recently, new and expanded rulemaking included these initiatives:

- “Best Execution”

- “Senior Protection”

- “Retirement Account Department of Labor Fiduciary Rule”

- “Retail confirmation disclosure” (May 2018)

Without question all are sensible additions. Adapting existing and creating new policies to adhere to these new rules and many others has been burdensome on broker–dealer and advisory firms. Not surprisingly, FINRA notes the number of broker-dealers has declined to 3,835 in 2016 from 4,578 in 2010. Additionally, a number of the larger bulge bracket firms have reduced their footprints or exited entirely from certain bond market sectors. According to Federal Reserve 2016 data, dealers hold approximately $20 billion less municipal bond inventory than six years ago (2010).

With fewer firms operating, we are cognizant that market liquidity will experience more strain in times of tumult.

Additionally, during this same period of time, mutual fund holdings of municipal bonds increased $978 billion.

Which begs a question: “in a market sell-off, how will muni mutual fund and ETF values fare when funds sell bond holdings to meet investor redemptions?”

The question is valid, in our view, and serves to highlight a primary advantage of our clients’ separately managed account (SMA) strategy.

FINRA’s 360 program was launched in 2017 and is the regulatory agency’s self-examination initiative aimed at assessing and improving the organization. This is a good development and we are eagerly awaiting word on its findings and resulting actions.

THE IMPORTANCE OF THE MUNI MARKET AND QUESTIONS INVESTORS SHOULD ASK

The municipal bond market has approximately $3.8 trillion in outstanding issues with 2017 new issue volume exceeding $400 billion. The market is a valuable funding source for state and local projects that affect residents’ quality of life. Much of the outstanding supply has financed our communities’ infrastructure: schools, libraries, town halls, county courthouse, water and sewer treatment plants, recreation facilities, airports, and hospitals.

Approximately 41% of outstanding bonds are held directly by individual investors (09/30/2017) and another 24% are owned indirectly by retail investors through mutual funds, exchange traded funds, closed end and money market funds according to Federal Reserve Board. Importantly, individuals are investing in our nation’s infrastructure when they purchase municipal bonds. They rely on the steady, secure interest payments as part of their investment and retirement strategies. These statistics show the important role individual investors serve in the municipal market making it incumbent on issuers, advisors, and broker-dealers to offer accuracy, completeness and transparency in their interactions with investors.

At Bernardi we are able to serve our clients as a portfolio manager either as an investment advisor or as a broker-dealer. Here are a few questions we encourage investors to ask their registered advisors and portfolio managers if provided through a broker-dealer:

- How are you compensated: fee-based, transaction-based, both ways?

- Will you itemize in writing all fees, expenses, mark-ups/downs?

- Are you subject to the fiduciary standard or suitability standard?

- Neither standard is conflict free; what are your potential conflicts under the fiduciary model, suitability model?

- How does your process and operating procedures mitigate potential conflicts?

- What is your investment process and philosophy: what is typical portfolio activity during the year?

- How do you source your bonds? How many middlemen are there between the bond you recommend to me and party you source it from?

- What are the costs of each iteration of question 7?

- What are your professional qualifications? What expertise and how extensive is firm’s network in this investment area? Can you access it and how?

- Who serves as custodian of my assets? Can I select another organization? If not, why? Do you have any conflicts in this area? Are you receiving direct or indirect compensation from your preferred custodian for client assets you direct to it?

This list is not complete, but it does cover many important issues. If answers to the above questions are not forthcoming, inaccurate or dismissive (“the question doesn’t apply to my model”), it indicates either an uninformed professional or someone appearing less transparent than what investors deserve.

At that point, the investor will have to make a decision whether to proceed with an incomplete picture.

THE BERNARDI MODEL – TRANSPARENT, HYBRID PLATFORM OFFERING CHOICE

We were heartened to read SEC Chairman Clayton’s remarks to the Senate Banking Committee last September which included an outline of the rubric he would use for an SEC sanctioned fiduciary rule. We have studied this complicated issue for many years and have spoken and written publicly about it.

Major themes of his remarks were that any new rule must preserve investors’ choices to use either an adviser or broker-dealer and that the standard needed to be applied consistently across all types of investment accounts. This is a solid foundation to help craft a much needed rule.

Leadership is about a willingness to consider new ideas, to engage thoughtfully, educate oneself, and execute a sensible solution to a problematical issue.

In 2000, Bernardi Securities, Inc. (BSI) formed Bernardi Asset Management (BAM), a SEC registered investment advisory firm. It offers fee only, fiduciary portfolio management strategies and is a wholly owned subsidiary of BSI. BAM was formed to complement our existing services so we could offer investors a choice of portfolio management options as a dually-registered firm.

The options are:

- Non-fee, transaction based bond portfolio management through BSI adhering to suitability, best execution, know your customer and other standards

- Fiduciary, fee-only portfolio management offered through BAM

Both portfolio management platforms rely on our internal municipal bond credit analysis process. It is robust, nuanced and time tested. The portfolio management team is the same for either option and the process is very similar. The options provide choices and are designed so our clients have cost effective access to our specialized management services in a way that best suits their situation.

We would be happy to discuss either option with you in detail.

Happy New Year.

Sincerely,

Ronald P. Bernardi

President and CEO

Bernardi Securities, Inc.

January 11, 2018