I hope you and your families are well. I hope everyone is safe. The current state of affairs all of us face is fluid, so I want to provide you with periodic updates. Thankfully to date, the entire Bernardi Securities team remains healthy, safe, and engaged in our commitments to our clients and enterprise.

As I wrote to you on March 23rd, our firm remains fully operational. Our day-to-day operations are orderly as we serve our clients. We are accomplishing this through a combined system of remote access operations and lightly staffed crews at the Chicago headquarter office and downstate Peru and O’Fallon branches. Our business continuity plan has worked very well to date. It continues to evolve given the fluidity of this crisis.

Our goal is twofold: 1) help safeguard the health of our valued employees and 2) continue to serve our clients at a very high level despite unprecedented operational challenges.

We continue to provide these essential services:

- Bond Portfolio Management Expertise for Investors

- Market Liquidity for Investors and Issuers across the Country

- Access to Municipal Bond Investment Capital for Municipalities, School Districts, Counties, Water/Sewer Utilities, Park and Library Districts, Hospital, College and University Systems

Over the years I’ve often written: “Municipal Bonds Build America” and we are doing our very best to help ensure an orderly, functioning market.

An orderly and functioning capital market is needed to help formulate an effective response to the COVID-19 crisis. Enacting effective safety and health solutions becomes even more difficult if investment capital flow slows, becomes prohibitively expensive, or ceases.

We will continue to play our part by supporting our clients and colleagues who have relied on us for nearly 40 years. So, rest assured: we will continue to “Keep Calm and Carry-On”…though 6-feet away from one another.

Below is our current Market Commentary. Please call or email us if you care to discuss its content or any other topic. I thank you very much for your continued confidence in our team.

Sincerely,

Ronald P. Bernardi

President and CEO

*****

“I couldn’t do that. Could you do that? How can they do that? Who are those guys?” -Sundance Kid to Butch Cassidy in “Butch Cassidy and the Sundance Kid”, 1969

Befuddlement and confusion are understandable human reactions when a situation changes rapidly and profoundly. When normally effective counter measures prove meaningless, add anxiety to the mix.

Like Butch and Sundance, many bond market participants experienced similar feelings last month. Investors, issuers, portfolio managers, traders and regulatory authorities found themselves asking at some point: “What just happened?”

Here’s a brief recap to provide some context:

On March 9th a nationally recognized index of municipal bonds (Municipal Market Data or MMD) at day’s end yielded 0.57%, 0.91% and 1.38% for AA rated 5, 10, and 20-year bonds, respectively.

On March 10th, the seemingly endless bond yield decline reversed itself a bit as the same indices yielded 0.69%, 1.04% and 1.54%.

This upward trend of bond yields continued and accelerated over the next eight trading days. (Reminder, as bond yields increase, prices decline.)

| DATE |

5-year |

10-year |

20-year |

| 3/11 |

0.93% |

1.32% |

1.82% |

| 3/12 |

1.28% |

1.74% |

2.32% |

| 3/18 |

1.64% |

1.97% |

2.47% |

| 3/19 |

2.14% |

2.47% |

2.97% |

| 3/20 |

2.64% |

2.92% |

3.37% |

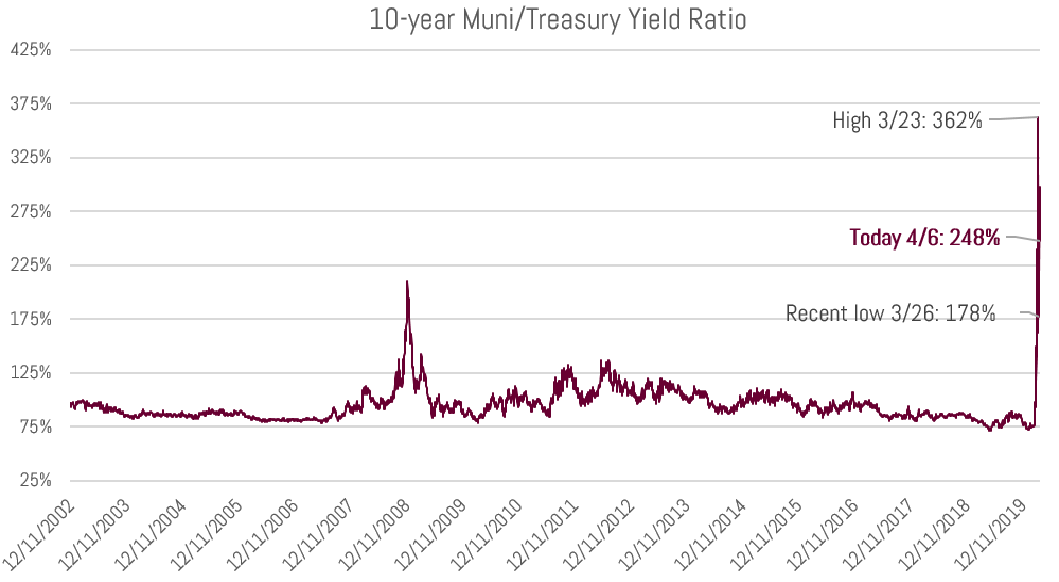

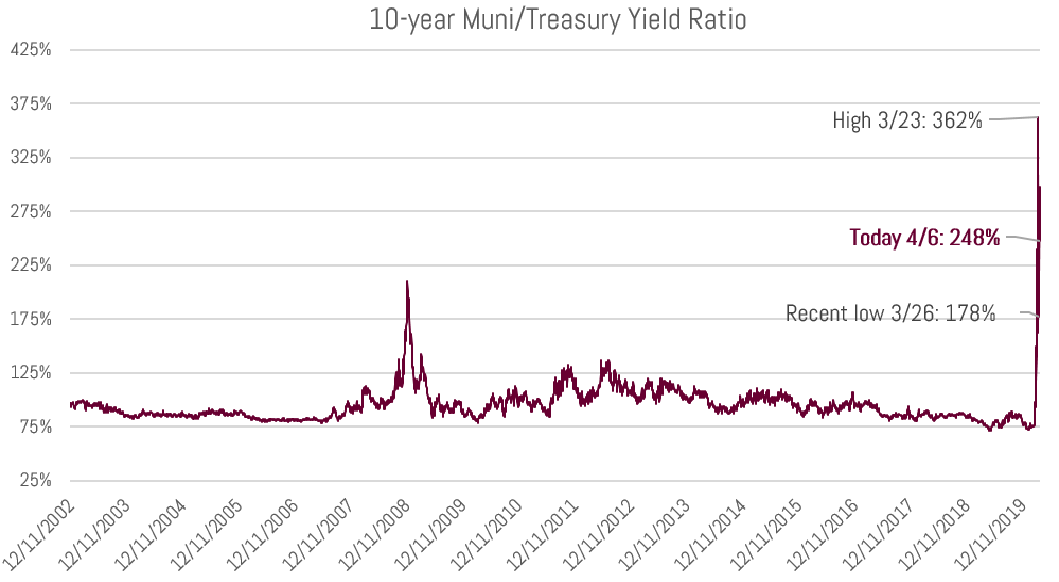

For a period of four days municipal bond prices plummeted and indices yields increased daily, 40-50 basis points. Across the maturity spectrum the yield ratio of municipal bonds versus U.S. Treasury yields moved far above historical norms as sellers across most markets sold bond holdings at deep discounts.

It was as if the ghost of Henry Kaufman – “Dr. Doom” himself – along with a panoply of 1980’s Bond Market Vigilante cohorts had simultaneously pushed the “SELL” button on their electronic trading platform devices!

It was a spectacle rarely seen in the “boring bond world.” And it happened quickly.

For many sellers it was unadulterated bond market carnage. For all buyers it was an opportunity they may not see for some time.

As quickly as the price sell-off began, it reversed in powerful fashion once the panic subsided and lawmakers authorized the Fed to assist state and local governments’ finances and price support its debt.

| DATE |

5-year |

10-year |

20-year |

| 3/24 |

2.41% |

2.72% |

3.17% |

| 3/25 |

1.76% |

2.07% |

2.52% |

| 3/26 |

1.23% |

1.47% |

1.92% |

| 3/27 |

1.17% |

1.39% |

1.84% |

Sizable paper losses that existed in investors’ portfolios and market makers’ inventories on March 23rd disappeared in a matter of days!

“I used to think if there was reincarnation, I wanted to come back as the President or…a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody”. -James Carville, Wall Street Journal February 25, 1993

For most of the last 10 years the bond market has hardly been intimidating. There have been brief periods of time over these years where markets were dicey, but they were few and short lived.

The mostly bullish, tedious, and predictable bond market of the last decade changed dramatically in March.

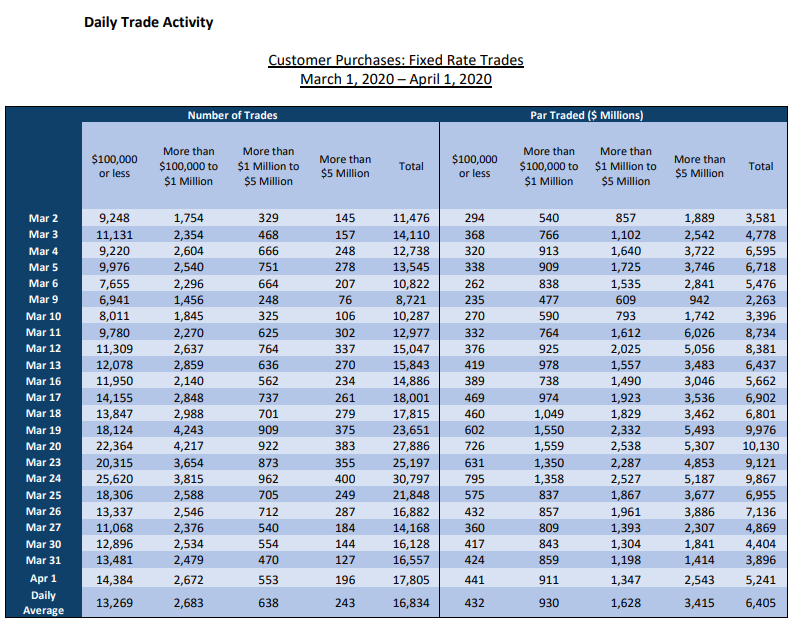

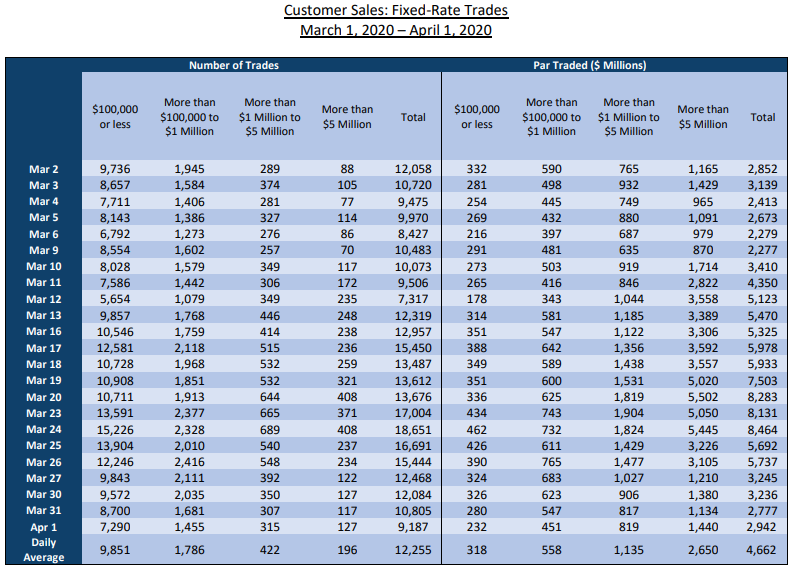

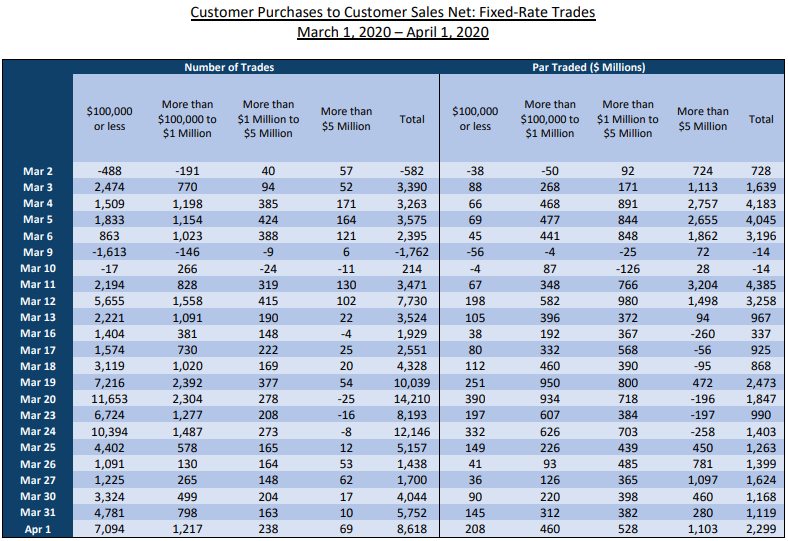

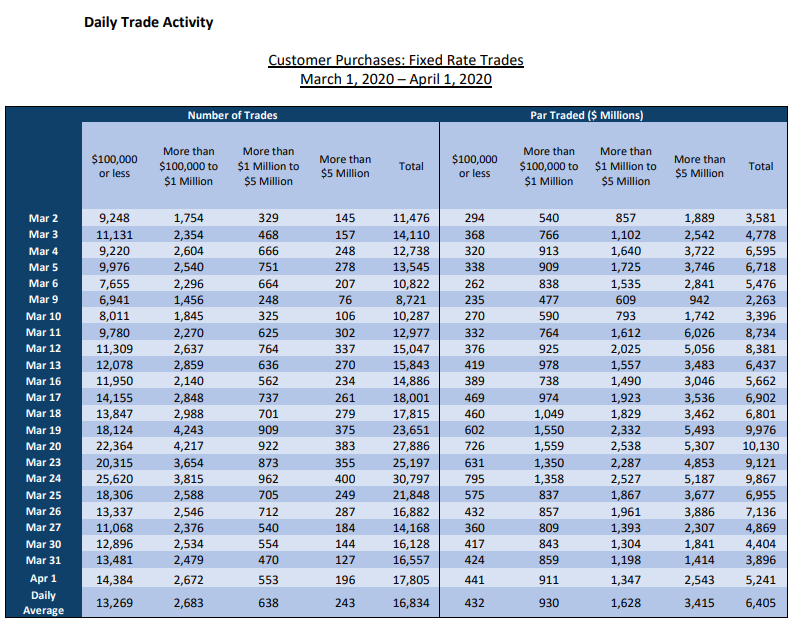

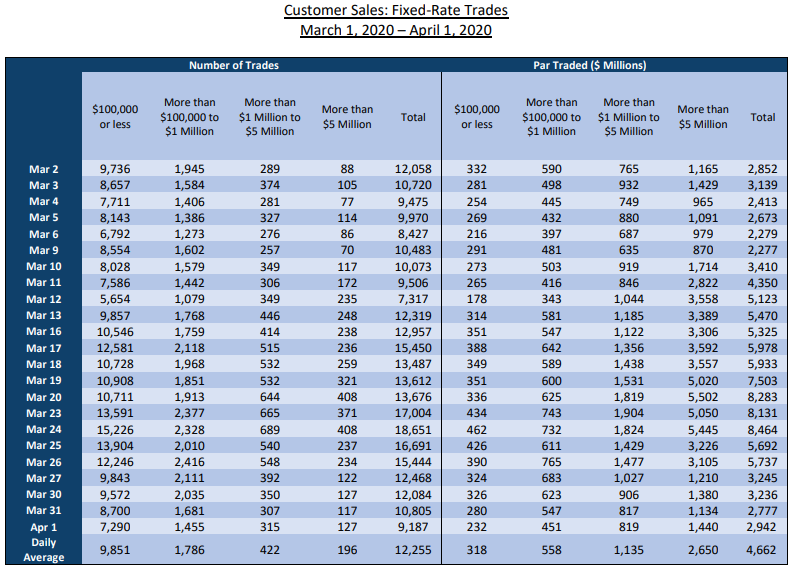

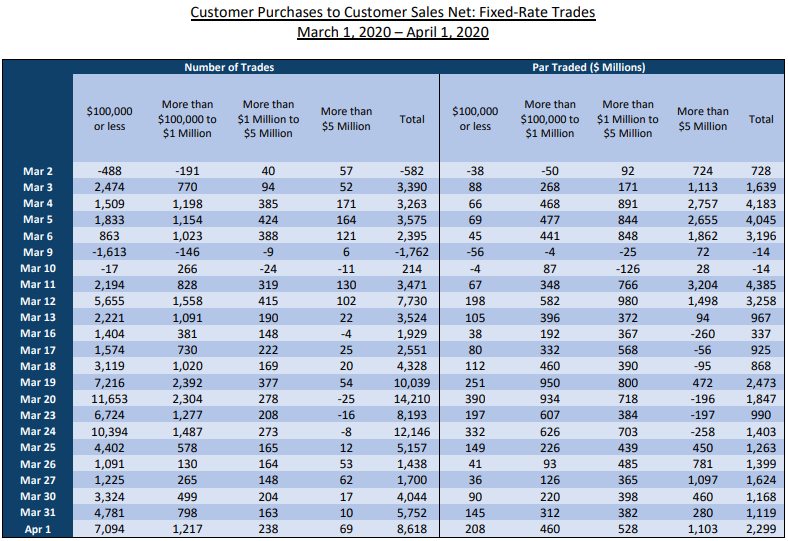

We’ve studied trading activity during the volatile market period last month to help us better understand what might have contributed to the severe fluctuation in prices. Below is market trading data as provided by the Municipal Securities Rulemaking Board (MSRB) drawn from three reports. The Tables show daily trade activity as follows: Table A. “Customer Purchases”, Table B. “Customer Sales”, Table C. nets the ‘Purchases” and “Sales” activity.

Table A:

Table B:

Table C:

Trading par value volume “Sales” activity spiked upward beginning March 13 and remained elevated until month end. This put intense downward pressure on bond prices. Table C. shows multiple days during this period when sales outpaced purchases even though purchases were quite elevated above the norm (March 20, 23, 24). Note the heightened level of trading volume by par value of large block sizes ($1,000,000+ and $5,000,000+) on these days. This activity corresponds with the sharp uptick in yields. This is evidence large institutional market makers and investors were net sellers putting significant downward pressure on prices pushing yields up much higher. This trading pattern does not occur in a normalized market dynamic.

Not coincidentally, investors pulled a record $12.2 billion out of municipal bond mutual funds in the week ended Wednesday March 18th. This was a continuation of the prior weeks’ negative flow trend which persisted daily until March 26th. For the most part, our clients’ Separately Managed Account (SMA) portfolios held up very well. Most portfolios reacted as we expected.

Forced selling by bond funds and portfolio managers, massive liquidations of ETFs and other bond-like products does not create realized losses if an SMA portfolio investor avoids selling.

Of course, SMA portfolio values on Friday March 23 were much lower than 7 days prior. But those lower valuations reversed themselves quickly, snapping back in subsequent days.

And for SMA managers and investors that exercised good judgement (and a bit of intestinal fortitude) and bought during this period – it was the bond market’s equivalent of the ultimate close-out sale.

Conversely, most investors in derivative (often complex in nature) type bond products: bond funds, bond ETFs, variable rate demand notes, tender option bond trusts realized significant losses during this period – even if they chose not to sell their shares when NAV values plummeted.

Here’s the rub with these derivative bond products: There’s often a fundamental disconnect between liquidity of the aforementioned bond derivative product shares and the underlying value of the investments they hold: it’s easier for investors to sell the fund shares than the underlying bond assets determining the share price. This is not a critique, but a statement of fact. This becomes hugely relevant when selling activity far outpaces buying activity as it did last month.

This disconnect is multiplied in times of extreme liquidity driven markets – when NAV prices plummet many investors realize losses whether they sell or not.

In a rapid-fire market sell-off the liquidity mismatch feature inherent in bond funds, ETF’S and other derivative fixed income products is the bond market’s metaphorical desert mirage. The efficiency and cost-effective premise promogulated by many of them is seriously challenged.

OUR SUGGESTED APPROACH

Bond market investing entails multiple risks: credit, interest rate and liquidity to name the big three. A successful strategy is designed around mitigating these elements.

Our bond portfolio management is conducted on a Separately Managed Account (SMA) platform only with transaction or fee-based options. Portfolios are laddered over a time period suited to the client’s needs and comfort level. The SMA structure allows for greater control over portfolio activity. We believe it is a more efficient and cost-effective method for high-net-worth investors to be active in the municipal marketplace. The events of the past few weeks confirm, once again, that belief.

Bernardi’s management strategy is based on a disciplined municipal credit analysis process developed over the past 50 years. It enables us to identify undervalued credits and identify issues with developing financial issues.

The core of our evaluation framework revolves around our “Three Pillars” of credit analysis: Deal Purpose, Deal Structure, Underlying Credit Quality.

Solid credit quality investing within a laddered SMA portfolio structure is a conservative (some say “boring”) and time-tested approach for income-oriented investors to participate in the bond market.

Simplicity has a place in investment portfolios – for some this is critically important in tumultuous times like the present. Perhaps the market volatility is behind us. No one knows with any certainty. But surely there will be more news and events related to COVID-19 confronting us which likely will roil markets.

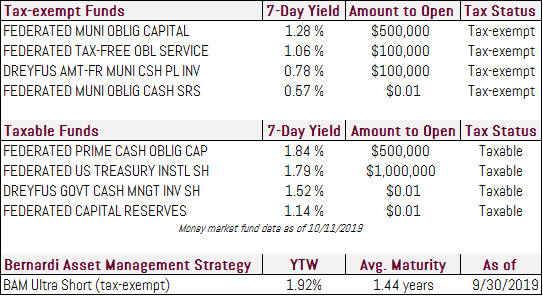

Volatility can be gut-wrenching, and it provides for opportunistic investing. Municipal bond yields remain elevated and continue to offer attractive value in our view. If your “mattress money” fixed income investment allocation has dropped below an appropriate percentage level for your situation, we suggest you call us or your investment counsel to discuss the issue.

Thank you for your continued confidence in our entire team. Please call or email us to discuss issues important to you.

Sincerely,

Ronald P. Bernardi

President and CEO